puerto rico tax incentives code

Tax on Capital Gains Dividends Interest Crypto Gains1 Up to 50. Sometimes effective tax planning can help avoid these taxes.

Puerto Rico Has A New Tax Incentives Code

USCIS administers the EB-5 Program.

. 21 of 14 May 2019 also known as the Development of Opportunity Zones of Economic Development Act of. Through this regulation provisions for Act 60 of 2019 known as the Puerto Rico Incentives Code went into effect with the purpose of establishing the norms requirements and criteria to be used in the application and awarding of the benefits granted under this law. It offers the following main tax benefits.

Back in tradeable tax credits on RD expenditures. The updated requirements are mentioned in this article but for ease we have kept the original names Act 20 and Act 22 when discussing these incentives. The two most popular programs offered by the Puerto Rican government are Act 20 and Act 22.

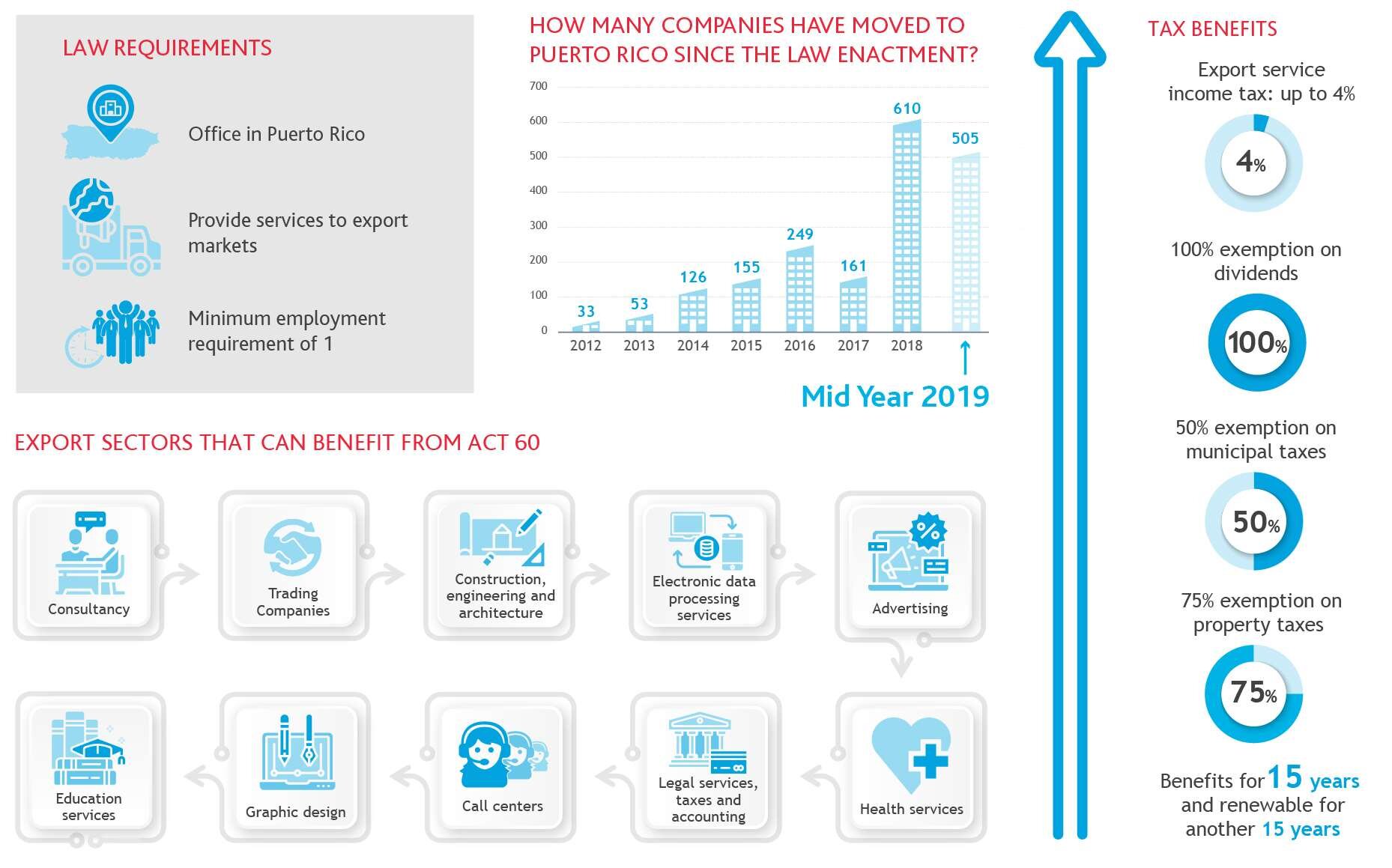

The purpose of the bill was to consolidate all tax and monetary benefits conferred through separate statutes into a single code and eliminate tax incentives that were. Act 20 also known as the Export Service Act targets certain service businesses by offering corporate tax rates as a low 4 to qualifying corporations that relocate to the jurisdiction. This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness.

As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code. 60-2019 hereinafter the Incentives Code. 60 known as the Puerto Rico Incentives Code which consolidates the dozens of decrees incentives subsidies reimbursements or tax or financial benefits existing at the date of its approval.

In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code. On July 1 2019. The process to grant and comply with the incentives should improve to become more efficient and easier for the beneficiaries.

Plan to create or preserve 10 permanent f. With an ever-growing array of services and emerging industries part of your success will be directly attributable to the incentives available. Taxes levied on their employment investment and corporate income.

Many high-net worth Taxpayers are understandably upset about the massive US. Puerto Rico Incentives Code Act 602019 Signed into Law. Puerto Rico Tax Incentives.

The Incentives Code consolidates incentives granted for diverse purposes throughout decades like manufacturing activities and. Puerto Rico Incentives Code Act. Make the necessary investment in a commercial enterprise in the United States.

The new regulation for Puerto Rico Incentives Code 9248 became effective on January 20th 2021. This resulted in some adjustments to the qualification requirements among other changes. On 1 July 2019 the Governor of Puerto Rico signed into law Act 60 also known as the Puerto Rico Tax Incentives Code Incentives Code which consolidated dozens of tax decrees incentives subsidies and tax benefits in a single statute including Act No.

Benefits of Owning Luxury Real Estate. Exempt business in Culebra and Vieques and new small and medium sized businesses have access to higher tax incentives see below. 1635 known as the Incentive Code of Puerto Rico and enrolled as Act No.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here. On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No. In order to bolster a diversified economy the local government has.

As provided by Puerto Rico Incentives Code 60. Back in tradeable tax credits on RD expenditures. Puerto Ricos Incentives Code Act 60-2019 was signed.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code. An economic development tool based on fiscal responsibility transparency and ease of doing business. The new law does NOT eliminate the existing incentives.

The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019 known as the Incentives Code of Puerto Rico the Incentives Code. Last reviewed - 21 February 2022. The Puerto Rico Incentives Code Act 60 helps build a vibrant community by promoting economic growth through investment innovation and job creation.

Fixed income tax rate on eligible income. Fixed income tax on eligible income. Exempt businesses with 2 tax rate.

The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks. Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors Act was approved by the Legislative Assembly of Puerto Rico during 2012. Under this program investors and their spouses and unmarried children under 21 are eligible to apply for a Green Card permanent residence if they.

Few places on earth offer a return on investment the way Puerto Rico does. Act 20 Act 22 Act 27 Act 73 Act 273. Promotes the environment opportunities and adequate tools to foster the.

In order to promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60. Enjoy Lower Taxes with Puerto Ricos Act 60 Tax Incentives Read More June 1 2021. Changes to Act 2022 New Incentives Code of Puerto Rico for Jan 1 2020.

SAN JUAN PR November 8 2019 Governor of Puerto Rico Ricardo Rosselló signed Act 602019 commonly known as the Puerto Rico Incentives Code into law on July 1 2019 with an effective date of January 1 2020The Incentives Code consolidates various tax decrees incentives subsidies. Puerto Rico Act 60 Incentives Code Puerto Rico Act 60 Incentives Code Tax Implications. According to Section 102001a61 of the Code a small and medium sized businesses is an Exempt Business that generates an average volume of business of three million dollars.

Corporate - Tax credits and incentives. Puerto Ricos Incentives Code. It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years.

Tax Incentives Benefits For General Practitioners Md Grant Thornton

Amendments To The Puerto Rico Internal Revenue Code Grant Thornton

Puerto Rico Act 60 Incentives Code Irs Taxation Overview

A Second Look At The Incentives Code Kevane Grant Thornton

Puerto Rico Incentives Code Tax Alert Rsm Puerto Rico

Solid Zirconia Veneers An Excellent Option To Block Out Dark Teeth Before After Adardentalnetwork Pinhasadar Adar A Veneers Dental Implants Teeth

Best Commercial Industrial Real Estate Listing Company In Puerto Rico

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Invest Puerto Rico The Puerto Rico Incentives Code Act 60 Compiles Most Of Puertorico S Tax Incentives Under One Law Establishing An Efficient Process For Granting And Leveraging The Benefits Of These

How The Build Back Better Act Affects Puerto Rico Puerto Rico Report

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Act 60 How You Can Lower Your Federal And State Tax Rates Under The Resident Tax Incentive Code Anchin Block Anchin Llp

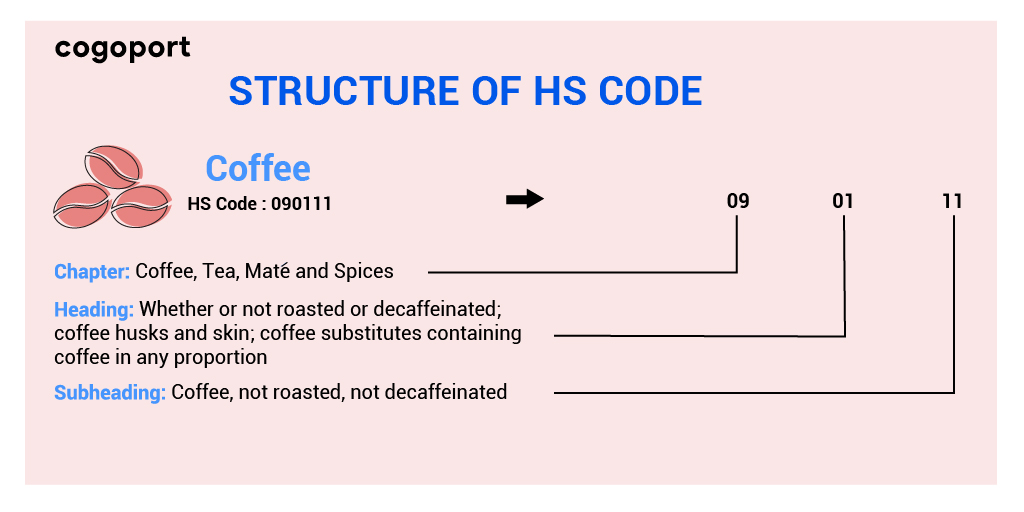

Hs Code All About Classification Of Goods In Export Import

Welcome Offer Thank You For Joining Welcome Welcomeemails Emailmarketing Email Newsletter Welcome Newsletter Welcome E Email Design

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Best Commercial Industrial Real Estate Listing Company In Puerto Rico