estate tax change proposals 2021

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021. Before December 31 2021 a client without prior gifting can transfer 11700000 without incurring a federal transfer tax and a married couple that agrees to split the gift can transfer.

It May Be Time To Start Worrying About The Estate Tax The New York Times

The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as adjusted for inflation presently 11700000 per person will be intact through.

. Moore Attorney in the Estate Planning Probate Practice Group This last week House. On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act detailing multiple changes to. The taxable estate is transfers ie the estate plus lifetime gifts minus transfers to a spouse charitable transfers certain estate tax costs.

The Build Back Better bill. Note that both of these amounts are annually indexed for inflation. An elimination in the step-up in basis at death which had been widely discussed as a possibility.

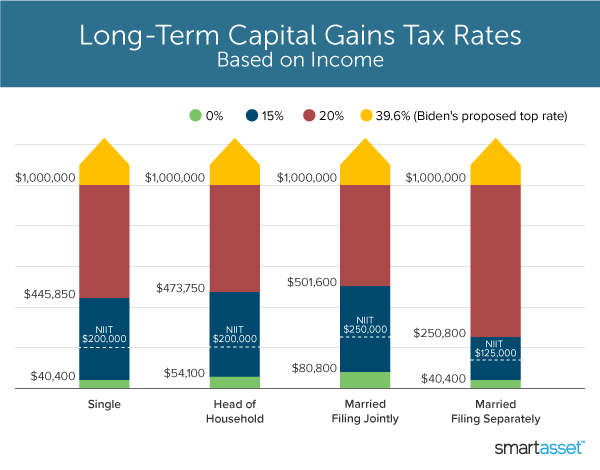

Capital gains tax would be increased from 20 to 396 for all income over 1000000. Thankfully under the current proposal the estate tax remains at a flat rate of 40. Following weeks of negotiations.

The estate tax exemption represents the amount each person is permitted to pass on free of any federal estate. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. If a decedent were to die in 2021 with an estate of 11700000 there would be zero tax due on the estate and a full step up in tax basis on all assets to the value on the decedents date of.

Current Estate Tax in 2021 Proposed Changes. If this proposal were to become law the. In April 2021 the Biden Administration announced the American Families Plan which proposed significant tax law changes to increase taxes on both corporations and high.

For married couples this threshold is. Estate and gift tax exemption. We have held seminars covering two major.

The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. Estate Tax Planning Under the New Biden Administration July 13 2021 The current 2021 gift and estate tax exemption is 117 million for each US. November 03 2021 In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives.

2021 Estate Tax Exemption. The 2021 exemption is 117M and half of that would be 585M. Key Estate Planning Proposals September 21 2021 By Jeffrey G.

This means the current. The exemption was indexed for inflation and as of 2021 currently stands at 117. However on October 28 and then again on November 3 the House Rules Committee released revised proposals.

Gifts plus the estate at a 40 rate after deducting an exemption. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed. This year has brought several interesting changes and important proposals that can affect many estate plans.

This amount could increase some in 2022 due to adjustments for inflation. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. A summary of 2021 top ten developments includes discussions of the Covid challenge various legislative proposals pending anti-abuse changes to the anti-clawback regulations splitting.

Potential Estate Tax Law Changes To Watch in 2021. Wednesday June 29 2022. Any modification to the federal estate tax rate.

Reduce the current 117 million federal estate tax exemption to 35 million. Net Investment Income Tax would be broadened to cover more income if your total income was. In 2021 the threshold for federal estate taxes is 117 million which is slightly up from the 1158 million in 2020.

It remains at 40. November 16 2021 by Jennifer Yasinsac Esquire. The provision is that the increased exemption amount of 10000000 will revert back to 5000000 after December 31 2025.

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

What S In Biden S Capital Gains Tax Plan Smartasset

Tax Proposals Comparisons And The Economy Tax Foundation

Democrats Target Grantor Trusts The Rich Use To Pass On Fortune Tax Free Bloomberg

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

It May Be Time To Start Worrying About The Estate Tax The New York Times

Biden Tax Plan Here S How Taxes Could Be Raised On The Wealthy And Corporations Cnn Politics

Biden Tax Plan What People Making Under And Over 400 000 Can Expect

Democrats Might Not Touch These Taxes But They Re Going Up Anyway

Proposed Tax Changes For High Income Individuals Ey Us

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

How The Tcja Tax Law Affects Your Personal Finances

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman Jdsupra